You greenlight a tenant who checks all the boxes, but months later, rent’s late, the unit’s trashed, and you’re knee-deep in legal headaches. That’s what happens when rental verification isn’t done right. It doesn’t just slow your process, it bleeds your bottom line.

But, here’s the problem: only 1.7% to 2.3% of U.S. renters have rental payment data on their consumer reports. That means most background checks miss critical information about whether someone pays rent on time or maintains a property responsibly.

Without this step, warning signs go unnoticed, leases get delayed, and property damage or late payments become your burden. But there’s a way to avoid it.

The fix is straightforward: a rock-solid rental verification process. And this blog breaks down the proven steps to protect your bottom line and keep turnover low.

What does Rental Verification Mean Today?

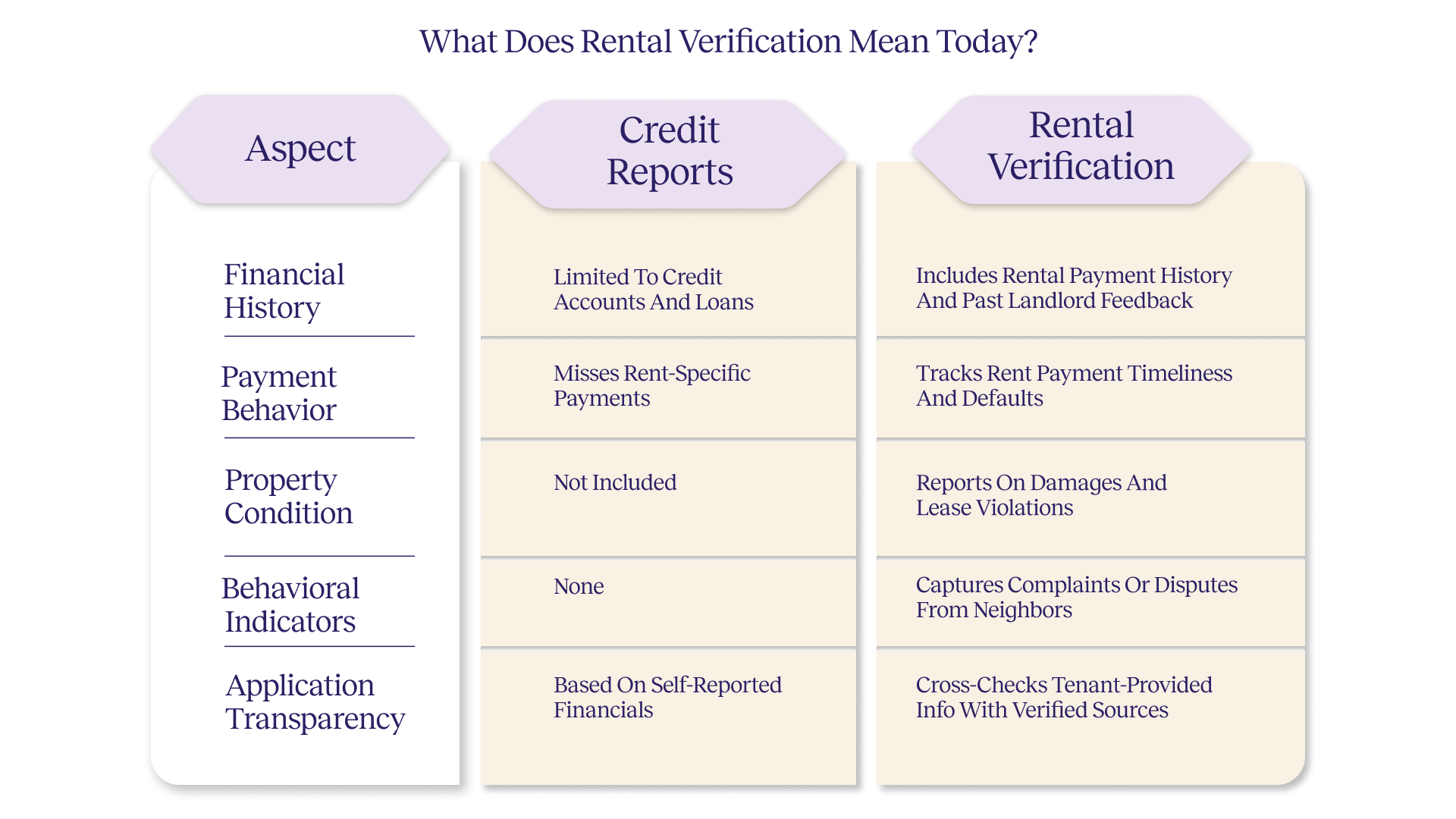

Rental verification goes beyond numbers. It tells you how a tenant lived; did they pay rent on time, follow the lease, and respect the property? For instance, someone may have a 720 credit score but left their last unit damaged with unpaid dues.

That’s not something a credit check will catch. Credit checks show financial habits; rental verification shows rental behavior. It includes landlord feedback, payment history, and any red flags.

Both matter, but together, they give you the full picture. Let’s see how they compare.

|

Aspect |

Credit Reports |

Rental Verification |

|

Financial History |

Limited to credit accounts and loans |

Includes rental payment history and past landlord feedback |

|

Payment Behavior |

Misses rent-specific payments |

Tracks rent payment timeliness and defaults |

|

Property Condition Insight |

Not included |

Reports on damages and lease violations |

|

Behavioral Indicators |

None |

Captures complaints or disputes from neighbors |

|

Application Transparency |

Based on self-reported financials |

Cross-checks tenant-provided info with verified sources |

Understanding rental verification today sets the stage to uncover the true financial risks of poor screening.

Financial Impact of Insufficient Screening Processes

Say you lease a $2,000/month unit to a tenant who seemed fine on paper. Three months in, they stop paying. You eventually discover two past evictions, but only after $8,000 in damages, two months of vacancy, and legal mediation.

All of this? Preventable with rental verification.

Breakdown of losses:

-

$4,000 missed rent (2 months)

-

$8,000 in repair and cleaning costs

-

$3,000 in legal and staff time

-

$1,000 in marketing + screening again

= $16,000+ in total avoidable loss

Most portfolios absorb this without asking why. But it’s one bad call you could’ve caught early, with a structured rental verification step.

Hidden Risk Multipliers Across Large Portfolios

One mistake is costly. But multiply that by 100 units? That's a silent revenue leak.

In portfolios of 100+ doors, 12 to 15 leases go sideways every year. Half of those issues, payment gaps, lease violations, and neighborhood complaints, can be traced back to what wasn’t verified during screening.

This wears down your ops team, stretches your legal budget, and burns out leasing staff who are stuck fixing preventable messes.

Also check out: The Future of Payment Systems in Leasing: Benefits of Offering Multiple Payment Options

Weak screening isn't just human error; it’s a broken system. Next: How to fix rental verification.

What are the Building Blocks of a High-Quality Rental Verification?

Strong rental verification is about structuring the right checks, validating every point, and asking the right people the right questions.

Below is a step-by-step framework, from what to collect to how to extract real behavioral signals from landlord conversations.

-

Complete Lease History: Dates, Amounts, and Gaps

Lease history is your timeline of truth. You need exact move-in/move-out dates, monthly rent amounts, and reasons for leaving.

Without this, you risk missing:

-

Gaps that hide evictions or subletting

-

Overlapping leases that signal dishonest applications

-

Rent inconsistencies that affect income verification

Cross-check these details with pay stubs or utility bills. If a tenant skipped three months between leases, find out why.

-

Verified Landlord Contacts: Trust, Then Confirm

Never call a reference without first confirming who they are. Fakes are getting smarter; some use fake websites and burner numbers. Ways to verify legitimacy:

-

Use county property tax records to confirm owner's name

-

Check LinkedIn or public listings for identity proof

-

Ask for lease or ownership documents if something feels off

Pro tip: If a landlord sounds hesitant to answer basic questions, they’re either fake or hiding something.

-

The Right Documents—Before Issues Show Up

Don’t just take their word for it. Always ask for:

-

Signed lease agreements

-

Security deposit letters

-

Move-in/out inspection reports

-

Rent receipts or digital payment proofs

This paperwork helps you spot serious issues early. A lease termination with a damages note is a clear warning. A history of paying rent only in cash? That’s another red flag. These small details can reveal bigger problems before it’s too late.

-

Rental Timeline Depth: Follow the 3-Year Rule

Aim for a 3-year rental history. It gives you enough detail to spot patterns without dragging out the screening process.

-

Students: Ask for college housing or RA references

-

Digital nomads: Use Airbnb reviews or remote work paystubs

-

Corporate tenants: Get letters from the employer’s HR or housing desk

Focus on consistency, not perfection. A solid six-month lease followed by a bad roommate situation says more than five years of unclear history.

Now, let's explore a key part of that process: speaking with past landlords.

From ‘Hello Tenant’ to ‘Rent Received’— Rioo Handles the Whole Show

Rioo’s Leasing Management suite covers it all, tenant acquisition and screening, contract handling, renewals, seamless move-ins and move-outs, plus collecting rents without chasing. It’s not just a tool, it’s your leasing command center; built to reduce friction, cut delays, and keep every lease lifecycle airtight.

Smarter leasing starts at RIOO!

What’s the Best Way to Contact a Previous Landlord?

Previous landlords provide critical insights into tenant behavior, payment history, and reliability, information you can’t get elsewhere.

-

7 Questions That Surface True Tenant Behavior

Skip vague questions. Ask specifics that reveal daily behavior.

-

“Did they ever miss or delay rent?”

-

“Was the property returned in good condition?”

-

“Did you ever have to issue a notice or warning?”

-

“Were there complaints from neighbors or staff?”

-

“Would you rent to them again without hesitation?”

The pause before the answer often says more than the answer itself. If they hesitate, dig deeper.

-

How to Interpret Legally Cautious Answers

When a landlord says something like “They completed the lease,” it’s not always good news, it may just be the safest thing they can say legally.

Read between the lines:

-

-

No praise could be a quiet warning

-

No mention of cooperation might point to past issues

-

A polite tone with no warmth means be cautious

-

Ask questions that feel safe for them to answer, like: “Would you rent to them again?” or “Any concerns if they applied today?” That gives you clearer insight without crossing legal lines.

-

No Response from the Landlord? Try This

If a landlord doesn’t respond, don’t ignore it—it could mean something. Take a few smart steps:

-

Send a certified letter with a return receipt request

-

Check eviction records or court filings tied to the property

-

Call the property management office directly if it’s a multifamily unit

-

Ask the tenant: “Why might your past landlord not be replying?”

Watch how they react. If their story shifts or they get defensive, look deeper. Sometimes silence is a warning in itself.

Verifying references is important, but spotting red flags is just as critical. Here's what to watch for next.

What Are the Rental Red Flags You Should Never Ignore?

Effective rental verification starts with recognizing the warning signs that most landlords overlook; missing these can cost you time, money, and headaches. Here are five red flags that demand your immediate attention:

-

Skipped Previous Landlord Contact

If a tenant refuses to share past landlord information, consider it a major red flag. This tactic often hides evictions, unpaid rent, or lease violations that can come back to haunt you.

-

Multiple Short-Term Leases

Leases shorter than nine months, especially repeated patterns, signal instability. Tenants with a history of hopping from one place to another may bring frequent conflicts or damage.

-

Late or Inconsistent Rent Payments

A shaky payment record is more than just an inconvenience; it predicts future cash flow problems and risks of missed rent. Here’s a breakdown of the best online rent tools for landlords who hate chasing - read here.

-

High Roommate Turnover

Constant roommate changes usually mean unresolved disputes or behavioral issues. This instability affects property upkeep and neighborhood peace.

-

Cash-Only Payments

Cash payments lack transparency and traceability. This increases the chances of missed payments and complicates any legal follow-up.

Lease it Right. Maintain it Tight.

With RIOO Leasing, finding quality tenants is just the beginning—streamline contracts, move-ins, and rent, all in one place. Then, switch to RIOO Maintenance—where every leak, light, and lawn is handled proactively.

Because a great property isn’t just leased well, it’s cared for even better.

Even when you identify key red flags, sometimes a clear rental history just isn't there. What happens then?

When You Can’t Verify a Rental History—Now What?

Not every tenant has a clear rental record. But that doesn’t mean you have to stop the process.

First-time renters? Focus on stability indicators. Ask for recent pay stubs, university housing confirmations, or employer letters showing consistent income and behavior. These aren’t just paper; they signal reliability.

Dealing with expats or global tenants? Accept notarized lease translations, embassy-stamped documents, or letters from overseas landlords. Just ensure everything is dated, signed, and clearly states the tenant’s history.

Still unsure? You can lower your risk without rejecting them:

-

Ask for a higher security deposit (where legally allowed)

-

Offer shorter lease terms as trial runs

-

Require a local co-signer to balance the unknowns

Also consider:

-

Checking professional references (especially HR departments)

-

Reviewing credit and employment stability as indirect proof

The goal is clear: reduce risk without losing good tenants just because of missing paperwork. But keeping track of these special cases manually? That’s where many teams struggle.

When rental history isn’t available, your process shouldn’t stop. Make smart choices without adding risk—this read helps.

Now, what's the final step to ensure you've covered all your bases? Let's talk about the final pre-approval checklist.

Final Pre-Approval Checklist

Rental verification is your quality control before signing the lease. This step ensures you don’t inherit tenant problems later. Treat it like the final safety net. Here’s a checklist to make decisions faster and smarter:

-

Confirm verified income and employment history.

-

Validate previous rental history for on-time payments and no evictions.

-

Ensure all consent forms and disclosures are signed.

-

Review background checks for any criminal or financial red flags.

-

Keep internal notes factual, concise, and compliant with legal requirements.

Clear team communication is important. Leave notes that are easy to understand and follow legal guidelines. If you need to reject an applicant, do it properly. Use rejection templates that follow FCRA rules—keep it clear, respectful, and compliant.

Skipping these steps can lead to delays, legal issues, or disputes. Rental verification protects you, so don’t take shortcuts.

But, how do you make this entire process consistent and efficient every single time?

How to Systematize Your Rental Verification Process?

Consistency in rental verification is essential. Without a clear, repeatable system, mistakes happen, follow-ups are missed, and your team wastes valuable time chasing down details. Start by equipping your ops team with reusable templates:

-

Call scripts to stay consistent during landlord reference checks

-

Email formats that clarify expectations and timelines

-

Document templates with legally clean language for disclosures and consents

Next, build an internal audit checklist, not for legal, but for process health:

-

Are we tracking follow-ups or losing them to inbox chaos?

-

Do we respond within 48 hours?

-

Is everyone following the same approval logic, or winging it?

Every 6 months, zoom out. Review key metrics:

-

Avg. time from inquiry to verification complete

-

Approval-to-rejection ratio trends

-

Dispute rate or tenant complaints post-verification

Rental verification is a core part of an efficient leasing process. When done right, it protects your property, accelerates approvals, and ensures smooth move-ins.

Don't miss: What High-Performing Property Managers Do Differently During Leasing Season

End Note

Rental verification is your first defense against leasing risk, and your last chance to prevent future headaches. It’s about building a clean, compliant, and confident leasing flow.

With the right process in place, you screen faster, reject smarter, and approve without doubts.

And that's what RIOO allows you to do.

RIOO’s Leasing module handles all the heavy lifting, automating rental checks, syncing with your CRM, and giving your team a clear, ready-to-use playbook for every applicant.

Cut the chaos. Close deals smarter. Book a demo now and make leasing hassle-free.