The U.S. property management market is hitting $42.78 billion by 2030, growing at 8.3% yearly. More properties mean more tenant money flowing through your books, and higher stakes if you mess up.

Here’s the reality: one mismanaged property management trust account can trigger compliance violations, fines, or worse, license suspension. That’s not the story you want to be explaining to stakeholders.

We get it. Between move-ins, owner payouts, and endless transactions, trust accounting can feel like one more fire to contain. But it’s one you can’t afford to get wrong.

TL;DR:

-

Set up the trust account correctly with a bank that understands real estate regulations.

-

Keep tenant funds separate from your business operating money, no commingling, ever.

-

Reconcile accounts monthly to catch errors before they snowball into violations.

-

Document everything; leases, deposits, withdrawals, and owner communications.

-

Restrict access; split duties for deposits, approvals, and reconciliations to reduce risk.

What Is a Property Management Trust Account?

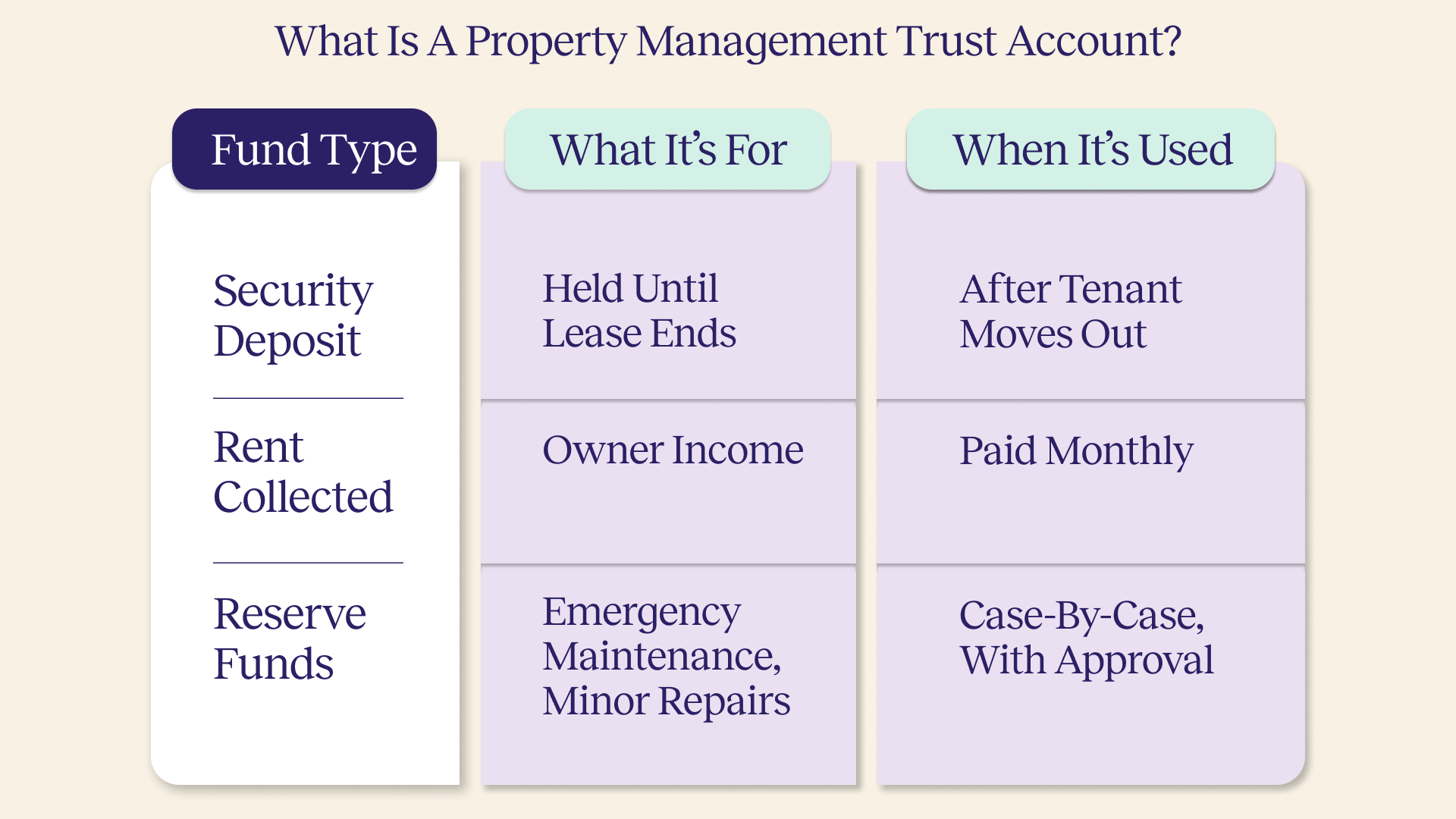

A property management trust account is a separate bank account that holds money you don’t own, like tenant deposits, rent collected for owners, or repair reserves.

Legally, you act as a trustee managing funds on behalf of the beneficiary, typically the owner or tenant.

So, what is a trust account in real estate? It's a controlled account required by law in most U.S. states to protect client funds from being misused, mixed, or frozen in case your business gets sued or goes bankrupt.

Say a tenant pays $2,500 as a security deposit. If that money lands in your operating account and your business gets hit with a lien, those funds can get seized, even though they’re not yours. That’s a trust violation, and it can get your license revoked.

Here’s how different funds are typically held and used:

Why this separation matters:

-

FDIC protects client funds only if they’re in a correctly labeled trust account

-

It shields clients’ money from your business debts

-

It creates a clean paper trail for audits and reduces the risk of accidental fraud

Put simply: if you're holding client funds, they don't belong in your business account, ever.

For more: Essential Guide to Property Management Accounting Basics

Now that you know the basics, here’s how to actually open a trust account correctly.

How to Open a Trust Account for Property Management?

Opening a property management trust account is more than paperwork. Done wrong, it exposes your business to legal risk, failed audits, and client distrust.

Here’s how to do it right, step by step.

Step 1: Understand your legal obligations

Before opening anything, check your state’s trust account laws. Each state defines:

-

What funds must go into trust (rent, deposits, reserves)

-

Whether separate accounts are required for security deposits

-

Timeline rules for depositing funds

Start here: Visit your state real estate commission’s website or NARPM’s compliance resources. Knowing this upfront prevents costly mistakes.

Step 2: Choose a bank that supports trust accounting

Not every bank understands property management. Choose one that:

-

Is FDIC-insured and recognizes trust account structures?

-

Allows multiple sub-accounts or client ledgers

-

Provides downloadable audit trails

Pro tip: Rioo compares banks against your state’s statutory requirements—helping you choose one that won’t get you flagged at audit time.

Step 3: Prepare your documentation

Most banks require:

-

Business license

-

Signed management agreements

-

Trust agreement with correct legal wording

-

AML/KYC documents

-

Board or manager resolution authorizing the account

Missing any of these slows you down. Get them in place before scheduling your account opening.

Step 4: Set up account titling the right way

Improper naming causes audit failures. Title your account like this: “XYZ Property Management – Trust Account”

And follow these rules:

-

Never combine trust funds with company operating funds

-

Open a separate account for security deposits if required

-

Match the account name to your agreements

Step 5: Configure internal controls before using the account

Before touching a dollar, define who does what:

-

Who can deposit or withdraw

-

Who reconciles

-

Who approves payments

Why it matters: One person shouldn’t control all access. It’s a compliance red flag, and a fraud risk.

Step 6: Follow your state’s deposit timeline rules

Funds are recorded and moved quickly into the trust account, following your state's mandated timeline. Always document:

-

Date received

-

Date deposited

-

Method of payment

Understanding the setup is one thing, now let’s break down how trust accounting works daily.

How Real Estate Trust Accounting Actually Works

Opening a property management trust account is just the start. What matters is how you manage it daily, without violating trust rules.

Here’s the typical flow:

-

Rent received → Tagged to the correct unit, tenant, and owner

-

Funds deposited → Moved promptly into the trust account per state timeline

-

Trust ledger updated → Each transaction recorded separately—no batch entries or shortcuts

-

Disbursements processed → Owner payments, vendor bills, refunds—all tied to supporting records

-

Reconciliation monthly → Bank balance, trust ledger, and owner statements must match exactly

Funds held in trust aren’t your income. Treating them as such, even briefly, is a fiduciary breach. Retain documentation for at least 3–5 years:

-

Deposit slips

-

Bank statements

-

Signed leases

-

Payment authorizations

-

Email logs for disbursement approvals

Trust accounting is less about math, and more about accountability. Every transaction should be explainable on audit day.

Knowing how it works is step one—now let’s structure it right to avoid future chaos.

Setting Up Your Real Estate Trust Accounting Structure

Once your property management trust account is open, the structure behind it determines whether you stay audit-ready, or constantly chase errors.

Here’s how to build that structure right from day one.

-

Chart of Accounts

Start with a detailed, segmented chart of accounts tailored for trust activity. This ensures every dollar is traceable.

Create separate ledgers for:

-

Security deposits

-

Monthly rent income

-

Owner draws and management fees

-

Maintenance reserves (if used)

Each ledger must be tied to a specific property, lease, or owner. Your trust structure should mirror your bank setup, this makes reconciliation straightforward and flags errors early.

-

Manual vs. Software Systems

Spreadsheets might work for a 5-unit portfolio. Beyond that, they break under scale.

Upgrade when:

-

You manage funds for multiple owners

-

Need sub-ledgers per lease or unit

-

Tax and audit reporting gets time-consuming

Why juggle spreadsheets when your books can balance themselves?

RIOO’s Finance & Accounting system auto-generates ledgers by property and owner, tags every transaction with precision, and keeps airtight audit logs. It enforces role-based approvals, too, so no payment slips through without the right signoff.

Book a quick walkthrough—see what clean accounting looks like.

Also read: Top Features to Look for in Property Management Software

-

Tenant & Owner Sub-Accounts

For every stakeholder, you need transparent, updated ledgers.

Sub-account statements should show:

-

Payment and disbursement history

-

Fee breakdowns

-

Running balances and notes

Structure is your safety net during audits, disputes, or license renewals. Set it up like your reputation depends on it, because it does.

Now that your structure is in place, let’s look at the habits that keep it watertight daily.

Daily Operations That Keep Your Trust Account Bulletproof

Your property management trust account needs rock-solid daily habits to stay compliant and audit-ready at scale.

-

Strict Segregation

Never mix trust funds with operating cash—period. Commingling funds triggers automatic license violations in most states.

Auditors flag mixed accounts instantly, leading to fines up to $50,000 per incident. Keep tenant deposits, rent payments, and security funds in a dedicated trust account for property management only.

-

Document-Forward Banking

Every dollar flowing through your account needs a paper trail. Require digital receipts for all transactions, match deposit slips to specific leases, and tie electronic rent collections to tenant records. Missing documentation during audits creates compliance gaps that regulators love to exploit.

-

Monthly Reconciliations

Reconcile your bank statements against ledger entries at least once monthly. Catch discrepancies within 30 days to maintain good standing with state boards. Late reconciliations suggest poor internal controls and trigger deeper regulatory scrutiny of your entire operation.

-

Vendor Disbursement Controls

Set up dual-signature requirements for payments over $500. Match purchase orders to invoices before releasing funds, and establish clear payment limits for different staff levels. These controls prevent unauthorized disbursements that could drain trust accounts and violate fiduciary duties.

-

Owner and Tenant Reporting

Provide monthly statements through secure portals with transaction details and current balances. RIOO's unified customer view gives owners real-time transparency into their property finances, reducing disputes and building trust with their client base. Want to see how it simplifies trust transparency? Get a demo.

Must read: How Centralized Property Management Can Improve Efficiency for Landlords and Managers

Even airtight setups can crack. Here’s what commonly goes wrong and how to fix it before audits hit.

Fixable Mistakes That Put Your Trust Account at Risk

Even experienced property managers slip up with trust account compliance. The following missteps are common, but preventable with the right process and tools.

-

Commingling Funds

Some operators still use one account for rent and operations. That’s illegal in most states. Regulators assume any shortfall is your fault, and you’ll be liable.

Fix it: Open a designated property management trust account. Use distinct ledgers for rent, deposits, and reserves. Never pay business expenses from it, ever.

-

Delayed Deposits & Disbursements

Holding funds past the legal window, usually 3–5 days, invites regulatory attention and fees.

Fix it: Set internal SLAs. Assign daily deposit checks to staff and automate alerts for any missed transactions.

-

Reconciliation Mismatches

Unexplained withdrawals and ghost transactions erode trust fast.

Fix it: Reconcile monthly. Use checklists to review each entry, flag discrepancies early, and log all exceptions with follow-ups.

-

Ignoring State-Specific Rules

California mandates dual trust accounts. Florida requires surety bonds. One-size-fits-all setups don’t work.

Fix it: Build a compliance calendar. Review state laws quarterly and align your trust accounting framework accordingly.

Maintaining cleanliness daily is one thing; staying compliant in the long term requires a different kind of discipline.

Staying Audit‑Ready and Compliant

Audit-readiness isn’t a one-time activity; it’s a mindset baked into your daily operations. The stronger your documentation and processes, the lower your risk exposure.

-

Compliance Obligations

Each state has its own unique real estate trust accounting laws. Some mandate dual trust accounts or specific reconciliation frequencies. You’re expected to know and follow them. Bookmark your state licensing board’s site and set reminders to review regulatory changes at least twice a year.

-

Record Retention Protocols

Regulators require you to store trust account records, bank statements, leases, receipts—for 3 to 7 years. Disorganized files or missing receipts are red flags. Keep everything digital, tagged by tenant or property, and stored securely in a searchable, centralized system with regular backups.

-

Planning for External Audits

Audit notices are rarely predictable. Build a quarterly checklist covering reconciliations, disbursement logs, and owner statements. Regular self-audits help you find issues early and fix them before they trigger fines, license penalties, or owner mistrust.

-

Responding to Subpoenas/Owner Inquiries

You need to retrieve documents fast during legal proceedings or owner disputes. A centralized document vault; organized by lease, transaction, and date, ensures quick turnaround and shows auditors you take fiduciary responsibilities seriously.

Tracking performance isn’t just about staying compliant, it’s how you spot issues before they become liabilities.

Tools & Metrics for Trust Accounting Performance

Numbers tell the truth, especially in real estate trust accounting. Tracking the right metrics shows where you're strong, where you're bleeding cash, and what regulators might flag first.

Here’s what top-performing teams monitor:

-

Deposit Lag Time: Time from rent received to banked, ideally under 48 hours.

-

Reconciliation Deficit Rate: Number of unreconciled entries; zero is the goal.

-

Violation/Incident Count: Compliance breaches logged in a year, keep this single-digit.

-

Owner Dispute Frequency: How often owners question statements, shows trust/account clarity.

-

Support Ticket Volume (Trust-related): Flags user friction in your accounting system.

Why Rioo Wins—All-In-One Beats All-Over-the-Place

Switching tabs doesn’t scale. RIOO’s Finance & Accounting module brings:

-

Auto-generated ledgers and sub-accounts

-

FDIC-compliant reconciliation workflows

-

Tenant/owner-facing portals with real-time views

-

Embedded audit logs tied to transactions

-

Smart alerts for missed deposits or anomalies

Book a walkthrough with RIOO—see what audit-proof really looks like.

Knowing what to do is half the job, now let’s map out who does what, and when.

Implementation Timeline & Internal Roles

Getting your property management trust account system running smoothly takes about 90 days. Here's the realistic timeline that actually works.

-

Phased Rollout

Week 1: Foundation Setup Open your dedicated trust account and establish the paper trail. Get your business banking documents, state licensing paperwork, and initial deposit ready. Set up automatic bank statement delivery and online access for daily monitoring.

Week 2: Systems Integration Build your ledger framework and connect accounting software. Import existing tenant data, set up chart of accounts, and create transaction templates. Test deposit and withdrawal processes with small amounts first.

Week 3: Process Testing Run complete reconciliation cycles using real transactions. Check that bank feeds match your ledger entries and identify any data gaps. Fix integration issues now before handling larger volumes.

Months 2-3: Live Operations Start your first audit simulation using RIOO's reporting tools. Practice generating compliance reports, documentation packets, and transaction summaries that auditors typically request.

-

Role Assignments

-

Bookkeeper: Daily transaction entry, monthly reconciliations, and ledger maintenance

-

Trustee Signer: Check approvals over $500, vendor payment authorization, and monthly account reviews

-

Internal Auditor: Quarterly compliance checks, documentation audits, and process improvement recommendations

Clear role separation prevents any single person from controlling the entire trust account process.

And with that, we come to the end of this blog!

End Note

Here's what matters most: get your legal setup right, pick the right bank, nail your daily habits, and keep everything organized for when auditors come knocking.

Most property managers spend way too much time wrestling with spreadsheets and wondering if they're doing things right. The smart ones use tools that handle the boring stuff automatically.

RIOO’s Finance & Accounting module takes care of the basics: tracking every dollar, keeping ledgers clean, and giving tenants and owners full visibility. It cuts out the manual work so your team can stay focused.

Book a demo and see how much easier trust account management can be.

Also read: The Role of Accounting in Scaling Your Property Management Business